sacramento property tax rate 2021

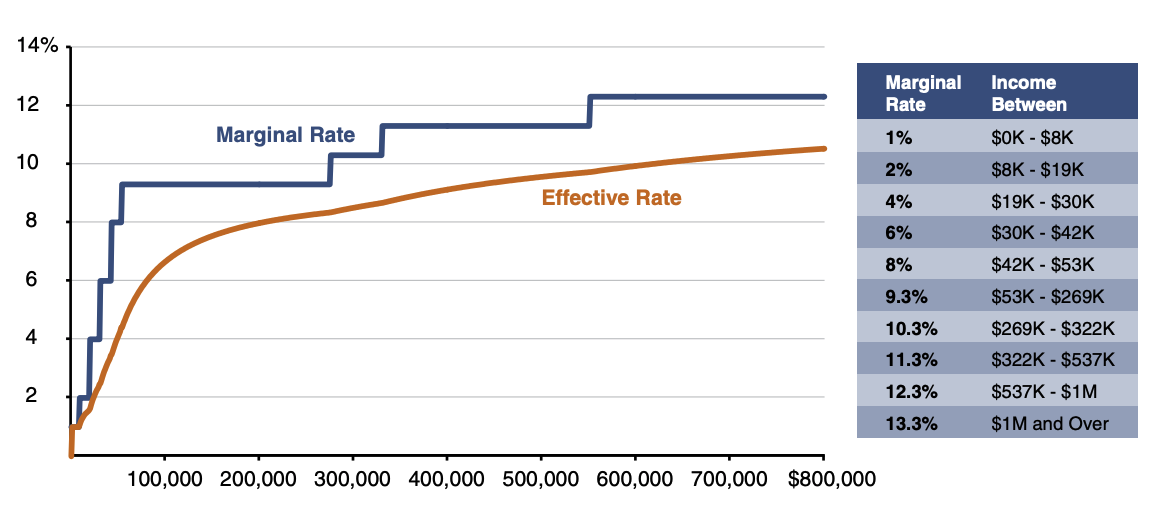

With the passage of Proposition 30 in 2012 and Proposition 55 in 2016 California now levies a 133 maximum marginal income tax rate with ten tax brackets state sales tax of 75 this sales tax increase was not extended by Proposition 55 and reverted to a previous minimum state sales tax rate of 725 in 2017. 94 billion 2021 Revenue.

California Government Benefitting From Rising Property Values Low Rates And Higher Home Values Increase Property Tax Collections Who Pays Tax Bill On Foreclosed Properties Dr Housing Bubble Blog

Cushman Wakefield proudly puts our people at the.

. Consult your Cardholder Agreement for details. Expedias Hotel Search makes booking easy. Neither H.

Married Filing Separately. Transfer California Property Tax for Homeowners 55 and over. King County collects the highest property tax in Texas levying an average of 156 of median home value yearly in property taxes while Terrell County has the.

New Jerseys median income is 88343 per year so the median yearly property. California homeowners 55 and older can get a one-time opportunity to sell their primary residence and transfer the property tax assessment to a new home under Proposition 60. H and R block Skip.

The median property tax in Orange County California is 3404 per year for a home worth the median value of 607900. Local governments can and do. Married Filing Jointly.

California already has the highest state tax and sales tax in the US and the Lyft proposal would impose a new 175 per cent tax on those earning more than 2mn. Our Mission - We provide equitable timely and accurate property tax assessments and information. The federal tax rate for your long-term capital gains depends on where your income falls in relation to three cut-off points.

An ideas company is by definition a people company. The exact property tax levied depends on the county in Texas the property is located in. The exact property tax levied depends on the county in Illinois the property is located in.

The property tax rate in the county is 078. Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143 counties in order of median property taxes. Roughly 45 of US.

Lake County collects the highest property tax in Illinois levying an average of 219 of median home value yearly in property taxes while Hardin County has. The median property tax in Mohave County Arizona is 916 per year for a home worth the median value of 170600. Texas is ranked 12th of the 50 states for property taxes as a percentage of median income.

Louis County collects on average 125 of a propertys assessed fair market value as property tax. Orange County has one of the highest median property taxes in the United States and is ranked 119th of the 3143 counties in order of median property taxes. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes.

Collier County has one of the highest median property taxes in the United States and is ranked 301st of the 3143 counties in order of median property taxes. If the property appreciated to 620000 when John sells he would pay tax on 20000 at favorable capital gains rate since inherited property is considered long-term property Rosen says. The median property tax in St.

The caveat here is the market value of the new house generally must be lower or equal to the home being sold. However standard text messaging and data rates may apply. Enter the sales and use tax rate applicable to the place in California where the property was used stored consumed or given away.

Mohave County collects on average 054 of a propertys assessed fair market value as property tax. What is the Florida Property Tax Rate. Households or 59 million didnt have a checking or savings account with a bank or credit union in 2021 a record low according to the Federal Deposit Insurance.

HR Block Maine License Number. 2021 HRB Tax Group Inc. The holding will call into question many other regulations that protect consumers with respect to credit cards bank accounts mortgage loans debt collection credit reports and identity theft tweeted Chris Peterson a former enforcement attorney at the CFPB who is now a law.

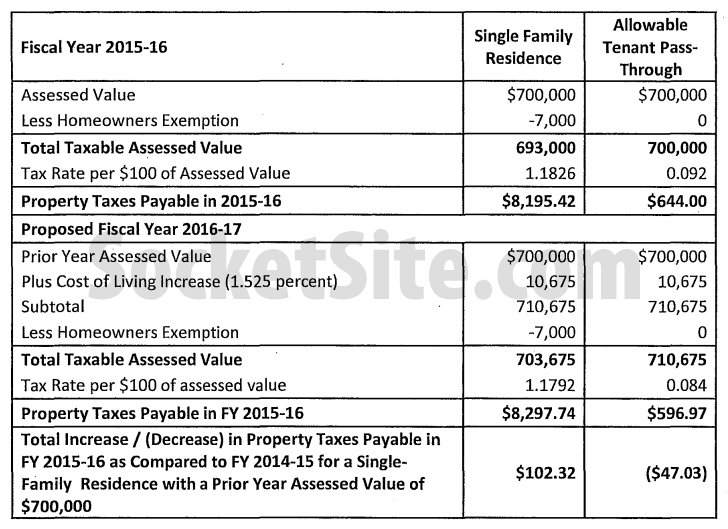

City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. Collier County collects on average 067 of a propertys assessed fair market value as property tax. Arizona is ranked 1632nd of the 3143 counties in the United States in order of the median amount of property taxes collected.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. Illinois is ranked 5th of the 50 states for property taxes as a percentage of median income. To find your sales and use tax rate please go to the California Department of Tax and Fee Administrations website at cdtfacagov and type City and County Sales and Use Tax Rates in the search bar.

Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games. Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the owner and publishing annual and supplemental assessment rolls. 2021 HRB Tax Group Inc.

The median property tax in New Jersey is 189 of a propertys assesed fair market value as property tax per year. The ballot measure created a tax on nicotine products such as e-cigarettes with scheduled increases. Microsoft has responded to a list of concerns regarding its ongoing 68bn attempt to buy Activision Blizzard as raised.

Here are the median property tax payments and average effective tax rate by Florida county. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. Orange County collects on average 056 of a propertys assessed fair market value as property tax.

Tax amount varies by county. Site selection and lease negotiations for occupiers of office retail and industrial based on workplace and logistics strategies. Microsofts Activision Blizzard deal is key to the companys mobile gaming efforts.

That means the impact could spread far beyond the agencys payday lending rule. The ballot measure increased the tax rate on cigarettes from 84 cents per pack to 264 per pack and the tax rate on tobacco products from 40 of the manufacturers list price to 62 of the manufacturers list price. Additional fees terms and conditions apply.

Pick the perfect hotel deal save. Tuesday Aug 23 2022 Extended Property Tax Exclusion Will Keep Clean Energy Investments in California. Learn more about the Missouri income tax rate and tax brackets with help the tax pros at HR Block.

Colorado Proposition EE. Capital gains tax rate 2021 thresholds. Today the California State Legislature approved a two-year extension of a property tax exclusion for solar projects providing stability to solar companies facing significant uncertainty around project development as they work to help California meet.

The median property tax in Collier County Florida is 2399 per year for a home worth the median value of 357400. Choose from thousands of hotel discounts cheap hotel rooms.

Sacramento County Ca Property Tax Search And Records Propertyshark

Residential And Commercial Property Tax Rates For 2021 In Every City And Town In Massachusetts Boston Business Journal

Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Sacramento County Ca Property Tax Search And Records Propertyshark

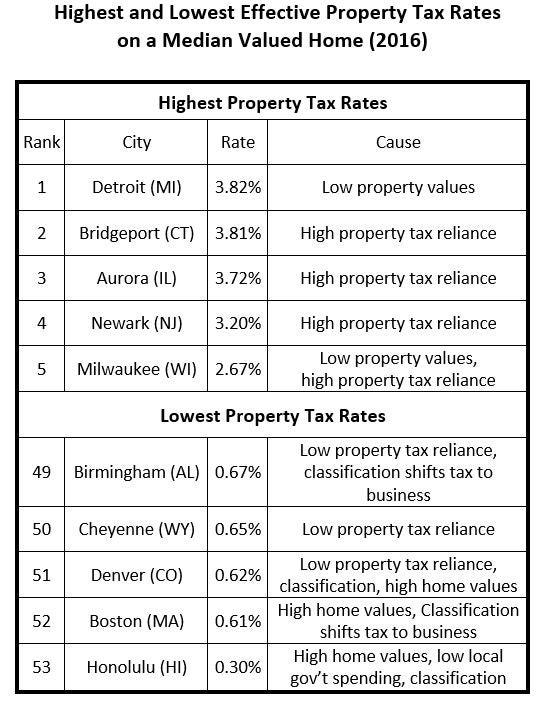

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Sacramento Ca Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Why November Could Mean The End Of Prop 13 And An 11 4 Billion Increase In Property Taxes For Commercial Owners And Tenants Sacramento Business Journal

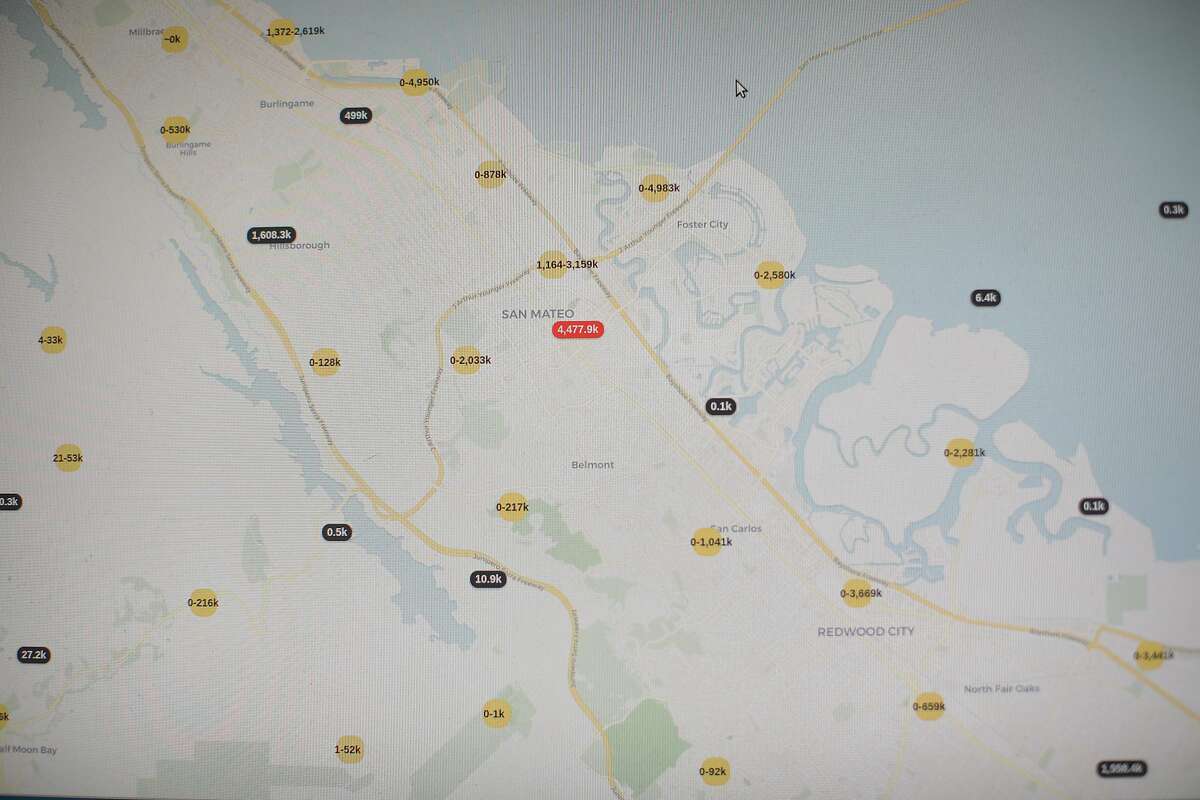

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

Secured Property Taxes Treasurer Tax Collector

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

Property Taxes Sandy City Ut Official Website

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

Property Taxes By State Embrace Higher Property Taxes

How Long Can This Market Keep Going Sacramento Appraisal Blog Real Estate Appraiser

Prop 19 Would Make Changes To California S Residential Property Tax System California Budget And Policy Center